Kenyans must pay more taxes for the government to have money for development projects, Deputy President (DP) William Ruto has said.

While justifying the forceful passage of the law by Members of Parliament (MPs) who faced opposition from the majority, the deputy president noted that the country must have adequate resources to take care of its future.

PLAN

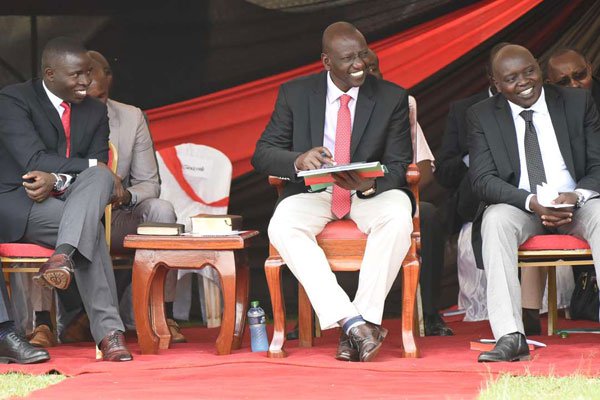

Speaking in Nandi County on Monday, Mr Ruto defended Finance Act, 2018, saying the government did not ask for taxes without a plan and is prepared to account for money collected from Kenyans.

“We have a comprehensive plan on how to utilise the funds. We cannot tax Kenyans without a clear plan,” he said at Kapsabet Showground during the launch of the county’s integrated development plan.

Mr Ruto further dismissed claims that the government is over-borrowing, reiterating that the money is used to transform Kenya.

He noted that the country’s debt currently stands at 5.8 percent of the Gross Domestic Product (GDP), which translates to Sh560 billion.

“We may have challenges here and there but tremendous transformation is going on in the country. Kenya will only move forward through development, not empty political rhetoric. Don’t listen to naysayers who have no plan for this country,” he said.

“As an independent nation, we have the power to choose our destiny and raise our resources. We are committed to prudent and accountable use of resources,” he added.

MEETING

The DP said they will meet MPs who opposed to the new Value Added Tax (VAT) on petroleum products.

He warned traders out to take advantage of the new tax against increasing the prices of commodities and services.

“The tax was only increased by eight percent. How does fare increase from Sh100 to Sh200?”

Mr Ruto also threw his weight behind the new housing levy, saying it is necessary to ensure affordable houses for Kenyans.

Affordable housing is one of the four aspects of President Uhuru Kenyatta’s Big Four Agenda. The others are manufacturing, universal healthcare and food security.

With the passage of the VAT on petroleum products and other revenue collection measures, the government expects to raise Sh48 billion.

President Kenyatta signed the finance bill into law after lawmakers backed his recommendations last Thursday.

“I give my commitment that I will ensure proper utilisation of public resources for a better Kenya. I will not relent in the war against corruption,” he said on Twitter.

The passage of the bill gives the president the legal mandate to levy new taxes he hopes will raise the Sh130 billion he needs to keep his spending plans on track.

The state intends to raise Sh17.5 billion from the tax on petroleum products, Sh9.8 billion from the kerosene adulteration tax. The imposition of a payment of Sh20 per kilogramme of sugar confectioneries, including white chocolate, will raise Sh473 million.

NANDI PROJECTS

The deputy president opened an operating theatre, renal and magnetic resonance imaging (MRI) units at Kapsabet Level V Hospital.

“The equipping of hospitals with modern machines, medicine supplies and improving infrastructure provides access to quality services. It ensures early, proper diagnosis and effective treatment resulting in a healthy population,” he noted.

Mr Ruto also visited Kapsabet Girls High School where he advised the learners to be disciplined and work hard and apply their knowledge.

“These attributes coupled with a conducive learning environment will guarantee success,” he told them.

Daily Nation